Carbon credits are crucial for environmental leadership, but success hinges on prioritizing transparency and integrity in corporate sustainability efforts

Environmental awareness is increasing worldwide and the effects of climate change are having far-reaching implications on stakeholders, including customers, investors, and regulators who are increasingly scrutinizing corporate environmental practices. While organizations should seek to reduce or remove carbon emissions as a result of their business, they are unlikely to be able to do this for 100% of their operations. In this context, the role of carbon credits in facilitating corporate environmental leadership has become more prominent than ever before.

How do carbon credits offset emissions?

Carbon credits represent a mechanism for reducing greenhouse gas emissions by enabling the trading of emissions reductions. Essentially, when a company takes actions to reduce its carbon footprint, such as investing in renewable energy projects or implementing energy efficiency measures, it earns carbon credits equivalent to the amount of emissions it has avoided or mitigated. These credits can then be sold or traded on the carbon market, providing financial incentives for emission reduction initiatives. While some corporations engage in voluntary carbon offsetting initiatives to enhance their environmental credentials and differentiate themselves in the market, others may be required to offset their emissions by regulatory mandates or industry standards.

Corporate environmental responsibility and CEO concerns

Corporate environmental responsibility has become a cornerstone of modern business strategy. Companies are under increasing pressure to demonstrate their commitment to sustainability, not only to meet regulatory requirements but also to align with consumer preferences and investor expectations. According to the latest Global CEO Survey by PWC, 45% of CEOs express concerns about the long-term viability of their companies if they continue on their current path. This sense of urgency reflects the growing recognition of the need for action to address climate change and other environmental challenges.

Benefits of carbon credits for corporations

The adoption of carbon credits offers several benefits for corporations. Firstly, it enhances corporate reputation and brand value by showcasing a proactive approach to environmental stewardship. Secondly, it enables companies to attract environmentally-conscious consumers who prioritize sustainability in their purchasing decisions. Thirdly, investing in emissions reduction initiatives and purchasing carbon credits can lead to long-term cost savings by improving energy efficiency and reducing operational expenses. Additionally, by proactively addressing their carbon footprint, companies can mitigate financial risks associated with future carbon pricing mechanisms and regulatory compliance.

How do you integrate sustainability into a business strategy?

Effective integration of carbon credits into corporate sustainability strategies requires a holistic approach that encompasses setting ambitious emissions reduction targets, investing in renewable energy projects, implementing energy efficiency measures, and engaging in carbon offsetting initiatives. By aligning carbon offsetting activities with broader sustainability objectives, companies can maximize the environmental and social benefits of their initiatives while enhancing business value and resilience.

What is the role of the CEO in climate change?

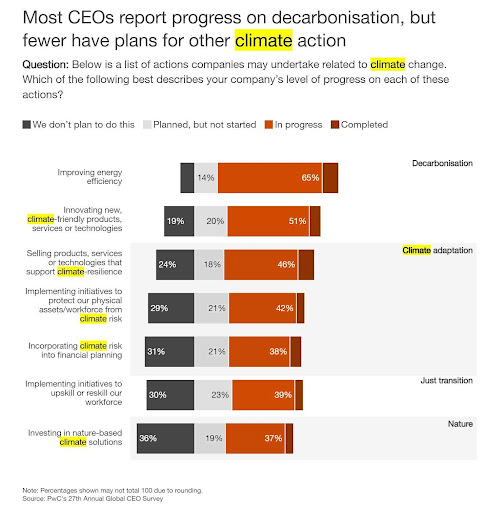

The findings of PWC’s Global CEO Survey reveal a sense of urgency among business leaders regarding the long-term viability of their companies. Despite an optimistic outlook on global economic growth, a significant proportion of CEOs express doubts about the sustainability of their current business models. The survey indicates that CEOs are increasingly prioritizing climate-friendly investments, with four in ten reporting lower hurdle rates for such initiatives compared to other investments. This demonstrates a willingness among CEOs to make complex trade-offs in pursuit of sustainability goals.

Is climate change a mega trend?

Climate change stands out as one of the most significant megatrends driving corporate reinvention efforts. While many CEOs have initiatives underway to improve energy efficiency and innovate climate-friendly products or services, there are notable gaps in climate action planning. For instance, a substantial number of CEOs have not yet incorporated climate risk into financial planning or considered the broader implications of climate change on their supply chains. This highlights the imminent need for a more comprehensive approach to climate adaptation and resilience.

What are the benefits of nature-based solutions?

A key aspect of addressing climate change involves harnessing nature-based solutions. With an estimated 55% of global GDP moderately or highly dependent on nature, the value of nature-positive business models cannot be overstated. Nature-based solutions, such as reforestation, not only help capture emissions but also enhance biodiversity, support local communities, and mitigate financial risks associated with nature dependence. As companies explore opportunities to align climate and nature priorities, they can create value while contributing to broader societal and environmental goals.

Nature related financial risk is estimated in the region of 45 trillion, and yet investing in nature-based climate solutions, according to the CEO’s surveyed is currently bottom of the priority list when it comes to their companies climate action. PWC is suggesting this is a blind spot for businesses and they go on to highlight an opportunity for organizations to address both climate and nature priorities through projects like reforestation and biodiversity financing.

What is net zero adoption?

In the absence of stringent government regulations on greenhouse gas emissions, an increasing number of companies are adopting net zero targets. More than one-third of the world’s largest publicly held companies have committed to reducing their emissions to net zero, signaling a shift towards greater corporate accountability for climate action. These targets typically involve a combination of emission reduction measures and the purchase of carbon offsets to neutralize remaining emissions. However, navigating the carbon credit market can pose challenges due to its complexity and lack of standardized practices. ClimateTrade offers a unique proposition as an open and transparent platform for the carbon market. Our centralized and fully digitized marketplace adheres to stringent voluntary carbon market (VCM) standards and promotes transparency at every step, we exist to empower corporations to navigate the carbon credit landscape with confidence and integrity.