Climate conversations will continue to dominate as severe weather events increase and nature-based solutions are set to lead the way in carbon markets.

As COP28 wrapped up and climate discussions briefly took a pause, Christmas festivities and New Year celebrations allowed us a moment of reflection on the past year. But we weren’t given much opportunity to hope for a more positive 2024 and the reality of climate change brought us back down to a turbulent earth. Japan woke up to a catastrophic Earthquake on New Year’s Day with threats of a Tsunami to follow. A tornado in Manchester also caused severe damages to homes and businesses as storm Gerrit swept the UK. Those that thought intense weather events could be left behind in 2023 can think again. The effects of climate change will continue to dominate conversations in the office, on the school-run, at the supermarket checkout and well, everywhere really. To put a positive spin on it though, we are encouraged by the heightened environmental awareness and confident it will lead to the prioritization of climate action. Welcome to the year dedicated to addressing climate issues. Here are our top 10 predictions for climate and carbon markets in 2024.

1. El Niño will peak and we’ll experience another record-breaking summer

2023 marked the beginning of the El Niño cycle, a natural occurrence that creates a warm water band in the Pacific Ocean, causing global temperatures to rise above normal. This cycle has pushed the world past the 1.5 degrees Celsius (2.7 degrees Fahrenheit) warming threshold for the first time in 2023.

El Niño cycle typically peaks from December to April so just as we have seen already with Japan and the UK, the most severe impacts are expected in the first part of 2024. Thought last summer was a hot one? Scientists anticipate the upcoming summer to be the hottest on record, offering a preview of the conditions we might experience in the 2030s.

2. Renewables will remain at the forefront of conversations

As severe weather events continue the transition away from fossil fuels and the move to renewables will dominate conversations on climate solutions in 2024.

A recent report by Energy and Climate Intelligence Unit’s (ECIU) Power Tracker found that from 1 January to 31 December, wind, hydro and solar power sources provided more than 90TWh of clean energy – enough to power every UK home in 2023. Reducing the reliance on gas in the UK is crucial to lowering energy costs. The UK has a higher gas dependency than any other country in Europe – 40% of power and 85% of home heating is currently accounted for by gas.

A recent renewable energy outlook report by deloitte shared insights on how generative AI could support renewable energy projects by overcoming project challenges. We saw many renewable energy project developers back out last year due to lengthy project timelines and rising supply chain costs. The report said:

‘Generative AI is powering new tools for developers to assess community sentiment toward renewables and automate permitting and siting. For the latter, generative AI can help select the best locations for renewable energy installations, considering wind patterns, solar exposure, and environmental impact. It can also suggest the best solar panel layout to maximize generation and design the most efficient blades with peak aerodynamics for wind. In 2024, more developers are expected to use generative AI tools to inform and accelerate renewable project decisions, processes, configurations, and community engagement.’

3. Consumer behavior will continue to be driven by climate considerations

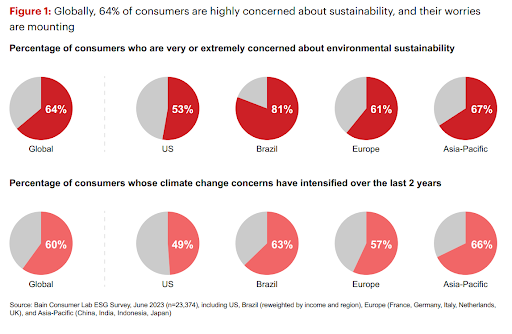

A recent report by Bain & Company shared data showing 64% of global consumers reported high levels of concern about sustainability, a figure that is set to increase. The majority of these consumers said that their worries have intensified over the past two years and that their concern was first prompted by extreme weather events.

According to Bain’s 2023 Consumer Lab ESG Survey, consumers are now willing to pay an average premium of 12% for products with reduced environmental impact. Moreover, those who express the highest levels of concern are willing to pay even more, depending on the specific product. This trend is gaining momentum, with research indicating that firsthand experiences of climate events have further heightened consumer apprehensions.

Many consumers have already been forced to change how they live and what they buy because of the impact of climate change, according to EY global research. It is no surprise when consumers are now increasingly worried about the health of the planet. Consumers are demanding so much more from companies they buy from and expect business leaders to prioritize climate leadership and reduce the impact of their business operations.

4. Business will prioritize supply chain decarbonization

It is no secret that having complete visibility over supply chains is no easy task, less so when it comes to sustainability. Surveyed by Bain & Company, many executives believe their efforts to embed sustainability are ineffective. Businesses have been slow to decarbonize their supply chains.

According to Bain’s research, around 24% of supply chains are not on track to meet Scope 1 and 2 emissions targets while 35% are going to miss their Scope 3.

This comes down to poor integration in operations, however, Bain believes there is still time to manage this while also reducing costs and building resilience. This is all down to strategy. As 60% of companies lack a feasible strategy for Scope 3 reduction, the research shows a significant shift in progress with a clear approach to their targets.

Companies need motivation, despite their best intentions to advocate for a more sustainable world. While major progress has been made to reduce fossil fuel emissions from some of the major industries, governments hold the power to influence businesses to make changes.

Moving early is key. By decarbonizing the supply chain ahead of competitors, the market will be less crowded, and it will be easier to sell lower-carbon products to customers and gain market share. In addition, investors tend to give higher valuations to companies with a lower carbon footprint. Finally, by starting before others, it will also be easier to secure access to raw materials that can be limited, such as recycled aluminum or green steel.

5. Private sector businesses will enhance net-zero strategies

It will take $4.6 trillion annually by 2030 to reach net zero by 2050. That being said, fewer than 40% of companies across sectors are on track to meet their various sustainability commitments. However, the turbulent years the private sector has faced, coupled with the severe weather events we have mentioned will only amplify net-zero and decarbonization strategies in 2024.

In ‘The Questions Every CEO Needs to Ask About Sustainability’ the drivers of net-zero strategies are outlined as:

-External demand for carbon neutral products (74%)

-Industry leadership and positioning (62%)

-Setting the basis for the future (42%).

Business leaders are continually being held accountable for their organizations impact on climate. It is clear that there is no silver bullet when it comes to net-zero and those in c-level positions will be looking for fully comprehensive solutions that cover multi-level impact. They will need to develop plans that can adapt to current market conditions and make allowances for future crises.

6. Carbon markets will combine to bring universal standards

Despite some criticism in 2023, there are signs that carbon markets are still high on the agenda for many companies building their net-zero and decarbonization strategies. In December we shared news of the ground-breaking collaboration between some of the Voluntary Carbon Market’s major players ICVCM, VCMI, SBTi and more to unite and help rebuild trust and confidence in the market.

Several studies have shown that organizations have shared insights that prove companies and organizations who purchase carbon credits are decarbonizing their own supply chains faster than those who don’t. The greenwashing narrative around carbon markets has been written to discredit a market that is actually responsible for channeling millions in global green investment.

The carbon market collaborations aim to simplify the market landscape, empowering buyers to acquire and retire credits with confidence. In 2024, we can expect these organizations to deliver on their COP28 announcements and provide clear, actionable plans. If successful, the endeavors to merge voluntary and regulated carbon credit actions like these could stabilize demand. This, in turn, would instill the confidence necessary for project developers and investors to scale the supply.

7. Carbon market buyers will seek premium, high-quality credits

Despite controversies, carbon market customers are keen to continue investing in carbon and biodiversity credits and to ensure they are doing so in an authentic and impactful way, they will seek out the highest-quality credits and will be prepared to pay a premium price for greater environmental impact.

Crucial insights in ‘The State of the Voluntary Carbon Market’ in 2023.’ has shown how the market evolved in 2023 and major players are looking ahead towards a stronger, more resilient 2024.

Stephen Donofrio, managing director of the report, said: “This is a critical moment for the voluntary carbon markets. While the data do not show the same type of growth by volume present in previous reports, our market analysis shows a critical, increased shift in market behavior towards integrity and quality, shown by an impressive uptick in average credit price. Buyers in the voluntary carbon markets are becoming increasingly sophisticated, and they want to know the true impact of their dollars.”

The report also highlighted carbon pricing, showing carbon credit prices rocketed from $4.04 per tonne in 2021 to $7.37 in 2022, higher than they have been in 15 years. While the VCM was more diverse and with a wider global reach, overall transaction volumes dropped by 51% from a 2021 peak. Issuances and retirements also increased in 2022.

Rather than considering this a “stalling” of the market, researchers interpret it as a “necessary regrouping” before an anticipated “acceleration forward”. The surveyed market participants also reported feeling optimistic about a rebound of the VCM in the near term, with a focus on high-integrity credits.

The Taskforce on Scaling Voluntary Carbon Markets estimated the VCM to increase 15-fold from 2020 levels and to be worth up to $50 billion by 2030,. Nevertheless, according to Trove, the world needs an additional $90 billion of capital from 2022 to 2030 to achieve the required volume of credits for meeting climate goals. SV Voic

8. Nature-based carbon credits will be prioritized

In 2024, the demand for nature-based carbon credits is set to skyrocket with more than 50% of the carbon credit demand in the financial services sector to be for nature-based credits.

Organizations purchasing nature-based carbon credits will be supporting initiatives that reduce and remove emissions, such as avoiding emissions through protected landscapes to limit deforestation or restoring ecosystems for carbon removal from the atmosphere.

There are several reasons why nature-based solutions are on the rise, one of the most prominent being the raised awareness of biodiversity conservation and habitat restoration due to the alarming rate of species decline.

It is also widely accepted that nature-based conservation is supported by consumers as they become more aware of what’s needed to protect the environment. Companies that actively support nature-based initiatives enjoy stronger brand reputations,

9. Access to climate science will Increase

In December Time shared an article highlighting the significance of major scientific publishers and institutions opening up their research and data to everyone. They reported that in 2023 more than 272,000 scientific articles were openly published in 2023, up from 233,000 in 2022 and just 167,000 in 2021. Anticipating a continued emphasis on transparency and accessibility, it is expected that the momentum of openly sharing scientific knowledge will persist throughout 2024.

10. The climate economy will continue to grow

In 2024, the climate economy is poised for sustained growth as the global commitment to environmental sustainability intensifies. The increasing recognition of climate change as a pressing issue has prompted businesses and governments alike to invest in green technologies, renewable energy, and sustainable practices. One notable trend contributing to this growth is the accelerating momentum of tokenization in the carbon credit market. As a digital representation of carbon credits on blockchain platforms, tokenization enhances transparency, traceability, and accessibility in carbon trading. This innovative approach is expected to gain significant traction in 2024, providing a streamlined and efficient means for businesses to participate in carbon offset initiatives, fostering a more dynamic and accessible marketplace for environmental solutions. Watch this space!

So there you have it, the effects of climate change are far too harrowing too ignore and while many countries are bracing themselves for extreme record breaking temperatures in 2024, new and innovative climate solutions are being explored to do all that we can to try and cool down the planet and mitigate the effects of climate change. This is one of the reasons the carbon market is evolving and set to grow exponentially in 2024. Organizations are aiming for carbon-neutrality and will explore an even wider range of solutions across their organizations and supply chains to reach their net-zero goals. Visit the ClimateTrade Marketplace to explore high quality and verifiable carbon, biodiversity and renewable energy projects to include in your net-zero strategy for 2024.