The UK has set ambitious net zero targets for 2050, but getting there, and overcoming some of the initial challenges will require significant collaboration and commitment as businesses adjust their operations to create a more sustainable enterprise.

Corporates, which contribute approximately 18% of the UK’s annual emissions (around 61.9 million tonnes), play a crucial role in this transition. A recent study by Lloyds: Credible Transition Plans: Reporting vs Reality, highlights the central role investors and executives play in our economy’s evolution. In this article we will review their findings and key insights.

Why is urgent action needed for climate change?

Climate change poses escalating risks that demand urgent action. Cleaning the air we breathe and slowing climate change could save millions of lives every year by reducing short-lived climate pollutants. In response, the Transition Plan Taskforce (TPT), launched by HM Treasury in 2022, introduced a comprehensive climate transition framework. This framework, designed as the “gold standard” for transition plan disclosures, aligns with existing frameworks like the Task Force on Climate-Related Financial Disclosures (TCFD), CDP, and the Corporate Sustainability Reporting Directive (CSRD) .

What is the biggest challenge in reaching net zero?

While the journey to net zero is crucial, there are significant challenges:

Governance and Reporting Gaps: Despite 80% of surveyed companies having transition plans, 45% lack reporting and governance frameworks. Additionally, 12% have no methodology to reach their climate goals. Effective measurement, governance, and reporting are essential for credible and actionable transition plans .

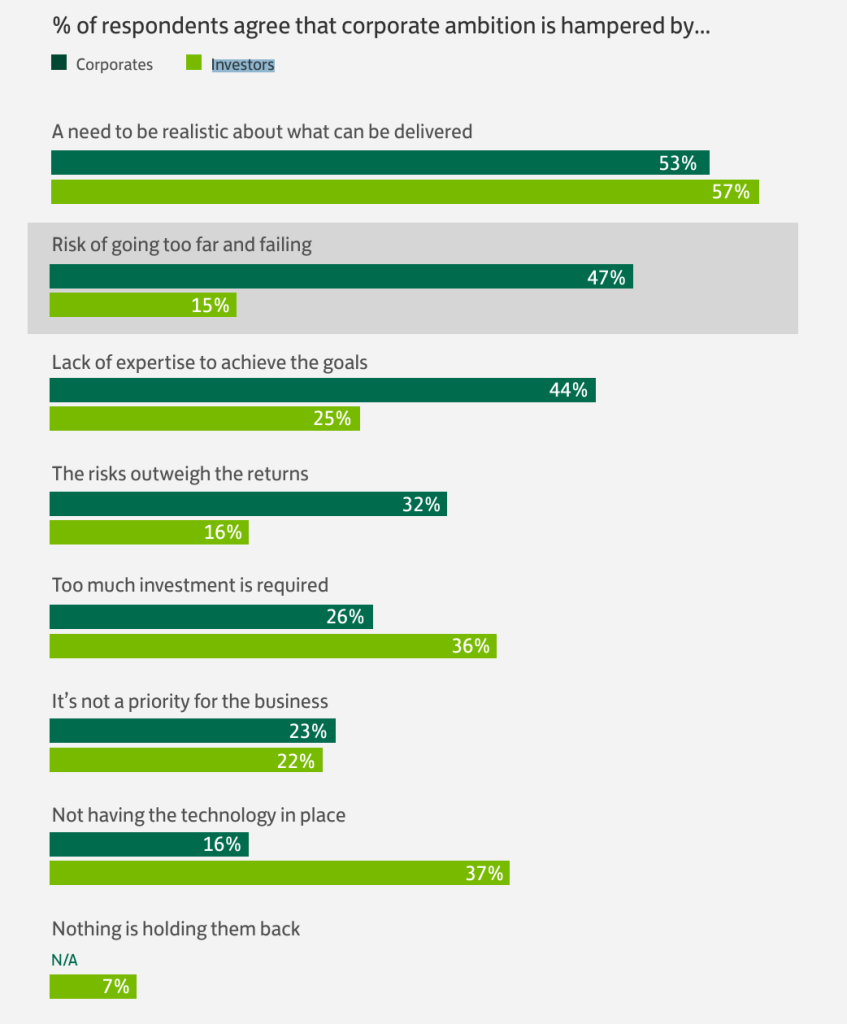

Fear of Failure: The fear of over-promising and under-delivering is prevalent among executives, with 53% citing the need to be realistic and 43% fearing reputational backlash from greenwashing scandals. This culture of caution hinders ambitious target setting .

Ambition vs. Credibility: There is a notable gap between what companies could achieve and the targets in their transition plans. While 63% of executives acknowledge they could do more to decarbonize, 93% of investors believe that at least some of their portfolio companies could be more ambitious.

Why is climate change important to investors?

Investors play an important role in driving climate action. Over half (54%) of institutional investors agree that companies with ambitious transition plans have a competitive edge, reflecting a strong market incentive for robust climate strategies. The majority (68%) of investors consider a company’s transition plan important when making investment decisions, with 26% describing it as “very important.”

How to build an effective climate transition plan?

To support the transition, companies must adopt a structured approach:

Measure, Analyse, and Set Science-Based Targets: Companies should measure their greenhouse gas emissions across all scopes, analyse the data to identify emission hotspots, and set science-based targets aligned with limiting global warming to 1.5°C.

Strategize for Decarbonisation: Develop a comprehensive strategy targeting the highest emitting areas and explore renewable energy sources, energy efficiency upgrades, and innovative low-carbon technologies.

Engage Stakeholders and Build Transparency: Collaborate with suppliers, customers, and peers to create a robust low-carbon ecosystem. Make transition plans publicly available, clearly explaining goals, strategies, and progress.

Invest in People and Skills: Equip employees with the necessary skills for the low-carbon transition through training and upskilling programs. Attract and retain talent with a strong focus on sustainability.

Align Governance and Reporting: Integrate climate action into corporate governance and hold senior management accountable for achieving goals. Regularly assess and report progress using standardised frameworks like TCFD .

The path to net zero is complex and requires concerted effort from corporates, investors, and regulators alike. When we overcome the blockers and embrace ambitious climate action, businesses not only contribute to global sustainability goals but also position themselves for long-term success in a rapidly changing economic landscape. Investors, recognizing the strategic importance of credible transition plans, play a crucial role in steering companies toward a sustainable future. Together, through collaboration and innovation, we can achieve the ambitious targets set forth and ensure a resilient and sustainable economy.

Carbon footprint management and offsetting carbon emissions

In addition to internal efforts to reduce emissions, companies can leverage innovative solutions like the ClimateTrade marketplace and API to manage their carbon footprint effectively. ClimateTrade’s platform enables organisations to accurately calculate their greenhouse gas emissions by integrating real-time data and advanced analytics. Once a company’s carbon footprint is established, we provide opportunities to offset unavoidable emissions through verified carbon credits. These credits fund various environmental projects, such as reforestation and renewable energy initiatives, allowing companies to neutralise their residual emissions. Working alongside the ClimateTrade team empowers businesses to achieve greater transparency and accountability in their sustainability efforts, contributing to their net zero goals while fostering environmental stewardship.