Santander, the global banking group, partnered with us to pioneer a groundbreaking initiative in the banking industry. Our collaboration enabled Santander to empower its customers to actively offset their carbon footprint by purchasing carbon credits assigned to certified projects.

This partnership exemplified Santander’s commitment to sustainability and provided a unique opportunity for customers to make a tangible impact on environmental conservation and renewable energy projects.

Santander, a global banking group headquartered in Spain, has a strong presence in retail and commercial banking across various countries.

With a history spanning over 160 years, Santander is committed to driving sustainable practices and reducing its environmental impact.

The bank is known for its commitment to innovation, customer-centric approach, and digital transformation. Santander Bank provides a comprehensive suite of products and services, including retail banking, corporate banking, investment banking, asset management, and insurance.

With a focus on fostering financial inclusion, Santander Bank strives to meet the diverse needs of individuals, businesses, and institutions, while maintaining a strong emphasis on ethical and sustainable practices.

During the United Nations Conference on Climate Change (COP25), Santander made a significant announcement, pledging to achieve carbon neutrality by 2020.

In their endeavor to embrace sustainable business practices, Santander sought to address scope 3 emissions and actively involve their customers in their sustainability journey.

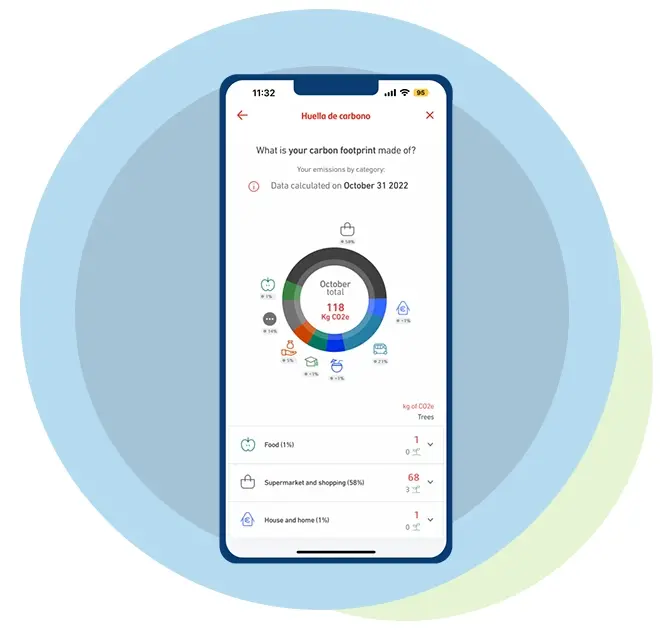

ClimateTrade provided Santander with a solution that allows its customers to measure their carbon footprint and take action against climate change. Through our plug-and-play API technology, Santander customers are now able to track their sustainable activity, receive eco-friendly tips, and access relevant information to reduce their carbon footprint, all within Santander’s own ecosystem via the website or banking app.

Additionally, customers have the option to voluntarily offset their emissions by participating in various projects that aim to prevent new emissions or absorb existing ones through carbon credits. Our blockchain technology ensures the traceability of carbon offset transactions, guaranteeing their real impact in the fight against climate change.

This collaboration enables Santander to support renewable energy generation, ecosystem conservation, and reforestation initiatives, aligning with their sustainability strategy and commitment to achieving net-zero emissions.

By collaborating with ClimateTrade, Santander empowered its customers to have a deeper understanding of their carbon footprint based on their purchasing activities.

This partnership offered transparency and valuable insights into the environmental impact of these transactions, enabling Santander customers to make informed decisions and take proactive steps towards reaching carbon neutrality.

Santander’s partnership with Climatetrade represents a significant step forward in the banking industry, as it demonstrates the bank’s commitment to sustainability and empowers customers to actively contribute to reducing Scope 3 emissions.

Santander chose ClimateTrade as its partner for carbon offsetting as we were able to provide seamless integration of our API directly into their own platforms and offer a secure and transparent marketplace, with high quality and verified environmental projects.

Santander were able to pre-select environmental projects that best aligned with their brand vision and values, while allowing their customers to select from one of these meaningful causes. They chose to focus on three initiatives in Latin America: a wind farm in Mexico, a reforestation project in Colombia, and a renewable energy plant in Brazil.

Spanish travel company Ávoris Group is using the ClimateTrade Whitelabel to offer customers the option to offset the carbon…

Spanish oil and gas company Cepsa is offsetting around 55,000 tons of CO2 from heating oil consumed by its customers…

Chile’s shipping company Chilexpress is using the ClimateTrade API to allow customers to offset the…

Tu.com is Telefónica’s carbon neutral device marketplace. We have integrated our API Climatetrade into the purchasing process…

Tu.com is Telefónica’s carbon neutral device marketplace. We have integrated our API Climatetrade into the purchasing process…

When it comes to combating climate change, women are a key part of the solution. In this article, we explore the…

Banco Santander announced its commitment to be carbon neutral in 2020, offsetting all the emissions generated in…

© Copyright 2024 – ClimateTrade | All Rights Reserved